9. SAVERS BEWARE

For good reasons, people attempt to save a part of their daily production and earnings through various ways. Among the instruments of storing some of one's excess labor are savings accounts, savings bonds and homes; other forms of saving for a rainy day are pensions and insurance. Yet, beware, for impetus use of these ways of saving can cause long-term losses by fueling inflation. Inflationary suffering in the form of rising prices can result from an excessive growth of the money supply or a shortage of production. If one suffers from inflationary price rises, it is self-defeating to place one's savings into any enterprise that channels the dollars away from production, e.g., counter productive banks, bonds, homes, insurance or pensions. Production increases are needed to reverse the inflationary shortages, and if one's investments generate only dollar gains without production gains, one will lose his additional dollars to the shortage inflation due to undercapitalized production. A financial journal in 1980 reported one of the "best-kept" secrets on Wall Street: the movement of conservative institutions into the gold market., Listed among these institutions were the recipients of funds from savers, pensioners, insurees and alumni. A banker was cited as seeing the bank's gold acquisition as being a "prudent" action--the bank's other investments were losing money to inflation. Was it prudent? Excepting for the initial speculators in the precious metal bubble, anyone who bought either gold or silver was burned as the months progressed. By mid-1982 both metals had dropped two-thirds and nine-tenths, respectively, from their highs. When price rises of essential products are causing inflationary suffering, where should retired people have their savings? Should they trust banks, pensions or insurers who actively or passively cause cash-flow problems for production enterprises? For instance, banks court both the commodity farmer and commodity speculator, pitting one against the other for the available monies. This drives up interest rates and bank income. When commodity speculators are the final recipients of one's dollars, one should expect a rise in commodity prices; the producers of foodstocks and other essential items lack funds in whole or part. Does the interest return on one's savings, checking or money funds outweigh the inflationary losses due to production shortages, e.g., in cattle, pork and energy? Is it wise to have insurance with a company that offers a lower premium price but places its reserves in non-production businesses? If your health, fire and theft insurance reserves do not go into production then you can expect the resulting unemployed people to threaten your life, home, and automobile. How "prudent" are the Dutch people to fund insurance companies that have billions of dollars inflating American real estate prices when there have been housing-shortage riots in the Netherlands?,,, Are you an alumnus who is concerned about your college? If your alumni contribution is not channeled into creating more jobs, then you are defeating both the purpose of giving and the reason of educating. You might be funding unemployment for not only new graduates but for old graduates: you! One's investments and spendings determine whether inflationary suffering will further restrict freedoms. Costly, tardy and deficient political intervention would be unnecessary if people productively policed themselves and their investments. Unless you have buying power to throw away, beware of how you trade your free dollars. Otherwise, be aware that in the long-run no one beats inflation who stimulates inflationary gains--directly or indirectly. Savers should be aware of politicians or economists that say they must save more money in order to help America, e.g., Carter blaming the workers for not saving enough savings, or, Ronald Reagan gambling on more savings as the key to economic recovery. One economist preaching about savings is a commentator for CBS network and Newsweek magazine, Jane Bryant Quinn. In a system beset by misdirected use of savings, is she wrong to state that "Frugality pays when interest rates on savings accounts are beating inflation by 50%?" Besides, are you able to save enough money to offset your total inflationary losses which results from the counterproductive use of your savings by bankers? Keep in mind that the savings rate affects only part of your income--that which you can save--while inflation figures affect all of your income. A 1000% interest rate is a castle in the sky if the bankers cause inflationary destruction of your disposable income through unemployment which leaves you with no savings. As argued throughout this book, savings can be inflationary. The most obvious mechanism is the counterproductive loan by a banker which generates shortage inflation. Less obvious, consider what would happen if we saved all our money except for stingy spending on daily food. In effect, people would be hoarding the economic stimulus needed to sustain an economy, which if excessive, would cause a depression and much inflationary suffering in the form of widespread unemployment that cheapens people's time. The validity for how savings can cause inflationary suffering--cheapening human time through unemployment--is implied when economic policy-makers say that consumers are not spending enough, that is, they are saving too much. The precipitous economic slump in the final year of the Carter administration was attributed to consumers responding too completely to Carter's request that they cut their spending and save more; reversing themselves, the Carterites then asked people to be less frugal and to spend more, e.g., get out the credit cards. Similarly, the peek-a-boo recovery of the Reagan recession was ascribed, in part, to insufficient consumer spending. The chief economist in the Commerce Department said in Summer 1982, "The consumer is going to have to bring us out of this recession." Reagan, like Carter, called for and gambled on increased savings without realizing how increased savings is a double-edged sword. If people save all their money, inflationary suffering will intensify in the form of unemployment; this will defeat the intent of increased savings--stop inflationary suffering--as well as reverse total savings as the jobless deplete their savings. Blind homage to increased savings is a Trojan Horse. The desired duality of people both saving and spending is one of the many contradictions in supply-side economics. Theoretically, they want to have their cake and eat it; they want people to save all their earnings for investment while simultaneously buying all the products that the investment is supposed to spur. It can't happen. This expected double-use of the same money is in addition to the claim that the "non-inflationary" deficits of Reaganomics will be funded by savings: "Elementary arithmetic tells us they can't use the same savings twice," says Walter W. Heller. More correctly, the same money cannot be used three-times: savings for investment, spending as economic stimulus, and savings in financing federal deficits. Homes are another form of savings. A person can generate long-term losses by seeking fast money without producing new goods or services: necronomics. In the 1970's, homes were touted as a business opportunity for inflationary gains, that is, buy a house and build a nest egg as inflation increases its value. As another example of people attempting to get something for nothing, this sequence had to come to an abrupt halt as more people joined the bandwagon. Does a homeowner beat inflation through his house? Maybe once, but not anymore, for as with the precious metal bubble, only the people on the rising side of inflationary pyramid gained some financial returns; and any potential gains from inflation must be qualified.

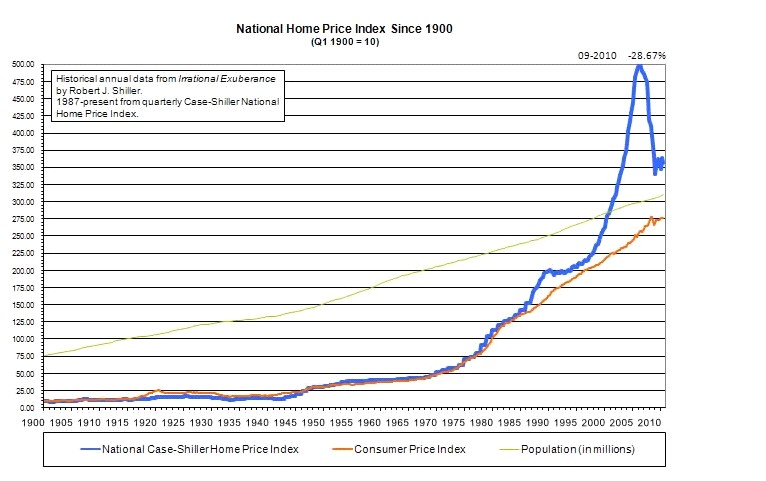

The anticipated inflationary gain from selling a home at an inflated price should be reduced by deducting the additional initial cost due to inflationary gains for the previous owner. And, many monthly inflationary losses plague the homeowner which cancel any final inflationary gains. Each month, the homeowning inflation chaser pays a premium for the financial killing expected when he sells his home. High inflation and interest rates occur simultaneously; each month, the eventual inflationary gain must be adjusted for the lost buying power due to the inflationary interest rate on the remaining principal. Not only are interest rates correlated with inflation rates but so are the costs of taxes, insurance, energy, food, transportation and crime. Are the consistent and rising inflationary losses of buying power during home ownership cancelled by the final inflationary gain? No! If anyone answers "Yes," ask them for their balance sheet. The tallied losses during the years of homeownership due to inflation would be greater than the chunk of inflationary gain acquired when the home is sold. The plight of the naive homeowner is analogous to the taxpayer who withholds more money for income tax than he is liable for. Sure, you might get a fat refund check; however, if you had minimized your withholdings--as the big money people do--and invested the money each pay period, you would have a fatter chunk of buying power when April 15 came around. Likewise, if homeowners did not have their monthly inflationary losses, they would have a larger chunk of buying power at retirement than the inflated equity in their homes. One is throwing away more buying power to monthly inflationary losses than is recouped from selling their home at an inflated price. In addition, this equity would be in excess and apart from their home, that is, all their eggs would not be in one basket. The single-dwelling owner does not beat inflation. When the homeowner sells (if he can in these days of rising unemployment and interest rates), to acquire another home, he must use all his "gains" if he is to maintain his standard of living. His paper returns were beating inflation only with the number of dollars, not buying power. The housing price changes of the 1980's has proven a logical sequence that shows how the average homeowner does not beat inflation, for inflation begins a cycle that eventually depresses home prices, life savings and employment opportunity. The initial inflation that prompts people to view a home as a business opportunity for speculation also begets high interest rates on loans and mortgages, the so-called "expectation of inflation" component. Besides making homeownership increasingly impossible for many people, the high interest rates affect the existing homeowners. Not only are their homes harder to sell but harder to keep, for high interest rates cause joblessness. [2006: The subprime mortgage follows this sequence.] Foreclosures are occurring even though the prices of homes have been dropping; in some areas, the prices have collapsed. What should have been foreseen as an inevitable sequence and prevented by taxation on inflation has come to pass for the homeowner who thought inflation was a way to free riches. In terms of the abstract reality of "excess disposable buying power", the stuff that puts meat on the table and chickens in the pots, inflation beats the homeowner. Of course, inflation beats the home-renter even more. Homeowners, like everyone else, can beat inflation only by promoting the stoppage of inflation. No one beats inflation letting inflation soar, even in housing. The widely touted advice to speculate for inflationary returns through buying a home is another example of necronomics. Savings Bonds Savings Bonds are advertized as an investment in one's nation, but as with any form of savings under the guidance of necrotic policy-makers, one should be aware that all is not as it initially seems to be. While America probably remains the best country in this declining world, the individual needs to realize that Savings Bonds are increasingly used to finance the ineptness behind foreign and domestic decline. Buying a Savings Bond no longer constitutes buying peace for America; actually, quite the opposite occurs. If one looks at the larger picture behind the thin veneer to buy Bonds--the politicized patriotic pitch--one finds injury to one's country and world. For some people, the objection against buying Savings Bonds is the insufficient financial return, a return consistently below other rates which has been characterized as a "rip-off" of the little guy. A more important reason for not buying Savings Bonds is the larger truth behind the thinly disguised hypocrisy--"Do it for your country"--by which people are psyched into accepting the low-interest rate of Savings Bonds. With each day of inflationary suffering, it is less true that a Savings Bond is an investment into one's country. More truthful, the purchases of Savings Bonds finance the inflationary budget-deficits which the politicians vote each year. Some Americans have realized this. As a retired machine repairman said, I had bought them as an investment in the country and I have just lost faith in the government ... I won't buy any more no matter what the interest is." The most important reason for not buying Bonds is how they are the opposite of an investment into one's country. No doubt this feeling played a role in why Americans in 1979 cashed in $7.7 billion worth of Bonds. By the nature of who really benefits, they should not be called U.S. Savings Bonds, but Politicians' Savings Bonds: They "save the politicians' bonds" on hoarding problem-solving power and responsibility. To buy a Savings Bond is to accept more than the loss of income due to the lower interest rates: a greater loss of income results from the rising inflation and unemployment that politicians will not or can not stop. Savings Bonds delay the day of reckoning when better policies are legislated and when the incapable politicians resign from public policy-making. The #1 symptom common to most, if not all, of America's problems is the incumbent or cloned politicos in elected office. The sooner the modern politicians are replaced by the presently extinct statesmen or are forced to come to grip with their mess, the sooner the Savings Bond will be, once again, an investment in America. Actually, productive policy-making will eliminate the need for not only Savings Bonds but the T-bills which also finance deficit-spending. Until the mess is understood and rectified, purchase of Savings Bonds serves to stimulate the rise of incompetence, corruption, inflation and unemployment. Purchasing bonds sadly increases the debt one ends up owing--body and soul--to the inflationary company store. With politicized government, no one beats inflation or helps America by buying or retaining a Savings Bond.

Warning: Anyone found

stealing lifehours will be forever banned from participation in and rewards

of Better Democracy and Capitalism. |